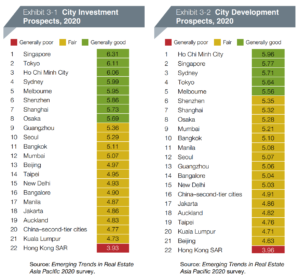

Sydney and Melbourne ranked near the top of this year’s survey as part of the Emerging Trends in Real Estate Asia Pacific 2020 report.

According to the report, “Australian markets offer good (for Asia) yields, reasonable liquidity, ongoing rental growth, a reliably strong economy, and even a weak currency to boost the appeal for offshore investors.”

RCA data show that in the first half of 2019, Australian investment volumes rose 3% year-on-year, making it the only one of the five busiest markets in the Asia Pacific region to record an increase in transactions.

One surveyed investor said “Australia is pretty fully priced, but I think maybe late-cycle people gravitate towards the most efficient markets, and I would put Australia on the list of very efficient markets.”

Continued strong performance across the office and logistics sectors supports investor enthusiasm. For the second quarter of 2019, Savills research showed continued rental growth in Australia as well as ongoing yield compression, even in Sydney, where average prime office yields are now below 5%.

In the future, there is a general assumption that Japanese institutional investors will also soon become major investors in Australian markets as they offer the kind of stability and liquidity that Japanese capital is searching for as it starts to diversify outside of Japan.

Overall, however, the outlook remains positive; 2019 is the 27th year since the last recession in Australia.

The full report is available to read here.