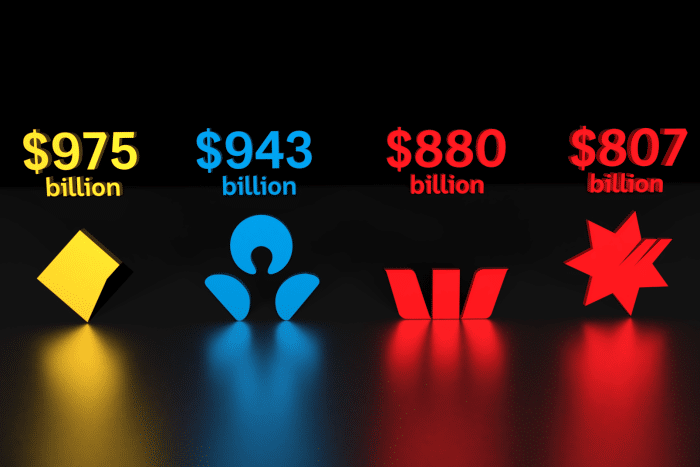

The Australian credit market has traditionally been dominated by four major banks: Commonwealth Bank of Australia, Westpac Banking Corporation, Australia and New Zealand Banking Group, and National Australia Bank. For the last several decades, these four banks (commonly known as ‘The Big 4 Banks’) have controlled up to 80% of the market.

Foreign banks have entered the Australian market to try and claim their share: Japanese banks in the 80s, European banks in the 90s, and Chinese banks in the 00s. While the entrance of these banks into market has introduced some much-needed liquidity, their effects remain intermittent and supplemental at best.

Supply and Demand

This lack of supply (relative to international markets) has created a power imbalance between borrowers and lenders in the lender’s favour. This has resulted in credit being provided with terms that are overly favourable to lenders; generally not a healthy sign for the future development of the economy.

Much of the demand for credit from the private sector is simply unmet by the traditional banking intermediaries. The Royal Commission into Misconduct in the Banking, Superannuation, and Financial Services Industry (also known as the Hayne Royal Commission) and the property cycle trough of 2018-19 tightened the Big 4 Bank’s lending as conservative elements gained traction. This made credit scarcer than ever.

It is this backdrop of macroeconomic factors that have contributed to the current market vacuum. This vacuum needs filling, and we believe that this is an opportunity for sophisticated investors to capture attractive risk-adjusted returns by providing capital-starved businesses with bespoke private financing solutions.

Why Private Lending?

There are many reasons for sophisticated, institutional investors to consider the Australian private lending market. Firstly, private lending activities within the Australian economy dwarf the activity in the public bond market.

Moreover, the private debt markets are a much better reflection of actual economic activity because, unlike the bond markets, which are almost always a reflection of big corporate issuers and their ability to achieve high grade credit ratings, the private debt market reacts to market forces of supply and demand more quickly and accurately. This is because private lenders tend to be the first to gather and digest new on-the-ground market information. Therefore, from a diversification perspective, there is a strong argument that the opportunities within the private lending environment significantly outweigh those on offer from public bond markets.

Indeed, we believe that the opportunities to glean relatively attractive risk-adjusted potential returns from Australian private markets will only grow over the coming decade. The LPE Fund, which is a credit fund, offers small-to-medium scale real estate development debt financing. This is a niche subset of the alternative asset class universe, offering low-correlation returns at very attractive levels to those investors who have the foresight and appetite to gain exposure to the growing trend of disintermediation in the Australian credit market.

About the Author

Lee Xie

Capital Advisory Director – Lion Private Equity

Lee is a Chartered Financial Analyst (CFA) and holds a Diploma in Financial Planning. Lee is also a fully licenced Real Estate Agent (LREA). Apart from having a background in credit, Lee has strong interests in equities and venture capital.

Lee started his banking career at ANZ as a Management Trainee in 2008, after graduating from the University of Melbourne with a Finance and Economics Degree (with honours). Armed with the knowledge and experience in credit, Lee went on to join two other international banks.